SBC Medical Group Holdings, Inc. Nasdaq: SBC Flash Report

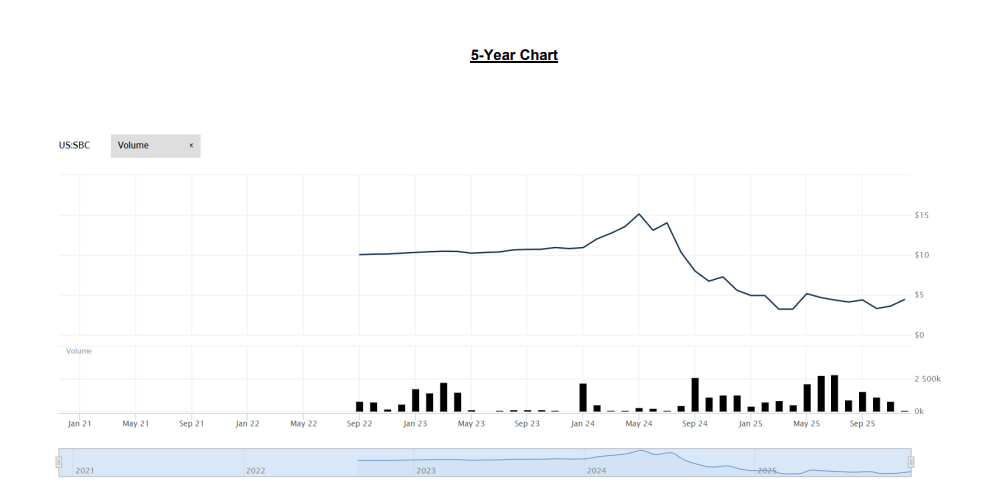

Global Expansion Proceeds, now into the U.S.: Long-term accomplished founder and management have shepherded SBC from a solo clinic in 2000 to become a global cosmetic treatment center franchiser and cash generation machine with little debt. However, revenue growth has declined in recent quarters yoy (which is expected to persist into early-2026), reflecting increased market competition pressure. Revenue growth has stabilized sequentially in Q3:25, though. Looking through the valley sees the Company growing again in early-2026 with prospects for global M&A in addition to opportunistic Japanese M&A. To that end, the Company has announced a new strategic minority equity investment and collaboration framework with OrangeTwist in the U.S., following a prudent phased global M&A process. Despite strong recent share price recovery, SBC remains heavily undervalued traditionally and via a DCF analysis (especially net of ample Net Cash). We remain bullish with a Buy-Extended rating and a $9.00 price target.

News

➢ SBC announced the completion of a strategic minority equity investment and the establishment of a structured collaboration framework with OrangeTwist, a leading U.S.-based MedSpa chain alongside its longstanding shareholders Hildred Capital and Athyrium Capital. This transaction marks the Company’s entry into the key United States medical aesthetics growth market – major milestone in SBC’s global expansion.

➢ OrangeTwist specializes in non-invasive aesthetic treatments at 24 locations across 6 U.S. states. With strong medical oversight and data-driven clinical operations, the company offers a comprehensive portfolio of injectable, energy-based, and regenerative treatments. Its advanced management system integrating procurement, clinical workflows, and real-time KPI tracking provides operational consistency and supports scalable growth.

➢ This investment marks the beginning of SBC Medical’s full-scale, multi-year, strategic expansion in the U.S. market through a committed partnership with OrangeTwist, and both companies will pursue joint operations that leverage cross-border synergies between the U.S. and Asia to support long-term growth opportunities. Risks

➢ Limited international experience in SE Asia and U.S. markets that are targets for global M&A. That said, SBC’s international expansion follows a 3-phase implementation process: entry, scale, leadership (e.g. partnering with high-performing regional operators, deploying SBC Medical’s differentiated operating expertise, and securing first-mover advantages). This prudent approach bodes well for future profitable growth.

➢ Revenue remains under yoy pressure, but revenue and sequential quarterly operating profit have stabilized. Japanese/global expansion is ongoing. Cash remains strong. Valuation

➢ SBC shares have recovered strongly off ~$3.00/share lows but remain beaten down longer term reflecting concerns about 2025 competitive pressures, though that is likely more than fully reflected in price. Management is also taking steps to improve liquidity.

Important Disclosures

Emerging Growth.com (“EG”) is a publisher and distributor of branded investment research reports provided by Emerging

Growth Research LLC (“EGR Report”) focused on both public and private companies. This report was prepared for

institutional and professional investors ONLY and it is also known as Company Sponsored Research (“CSR”).

Collectively, however (“EGR Report(s)”).

Be advised that this EGR Report is being provided by Emerging Growth Research LLC (EGR) solely for informational

purposes, is not the opinion of EG, should not be construed as an offer or solicitation to buy or sell securities, and should

not be considered in any decision to buy or sell any security mentioned within the EGR Reports. All information contained

in the EGR Report as well as on the EmergingGrowth.com website is obtained from sources believed to be reliable but

not guaranteed to be accurate or all-inclusive, timely, or correct. The information includes certain forward-looking

statements, which may be affected by unforeseen circumstances and / or certain risks. Because EGR is compensated as

detailed herein and EG receives Licensing fees from EGR, as also detailed herein, EG and EGR have a conflict of interest

and strongly urge you to consult your own independent financial, investment, tax and legal advisors prior to purchasing or

selling any securities mentioned herein.

The analyst that has prepared and is responsible for the content of this report has stated that neither he/she, nor any of

his/her associates both professional and personal, to the best of his/her knowledge have no personal or professional

relationship with any of the companies or principals of any companies mentioned within, other than providing services that

EGR may offer.

EGR is being compensated by the subject Company of this report. EGR was paid thirty-four thousand and two hundred

dollars and does not expect to receive an additional amount over the following six months. EGR may have also received

additional past compensation, EGR may receive future compensation, and EG may receive compensation for additional

services such as presenting on the Emerging Growth Conference or investor or public relations services, details about

which can be found in the full disclosure, here: https://EmergingGrowth.com/sbc-egr-report-disclosure/.

It is the intent of EGR to provide continuing coverage on a quarterly basis, or otherwise for the subject Company of this

report; however, EGR or EG will not notify readers of this report if coverage by EGR, for any reason, is terminated.

The reader or user of this content agrees that neither EGR and / or EG nor the analysts, directors, officers, employees,

representatives, independent contractors, agents, or affiliates of EGR and EG shall be liable or held liable for any

omissions, errors or inaccuracies, regardless of cause, foreseeability, or the lack of timeliness of this or any of our other

reports to users. This lack of liability extends to direct, indirect, incidental, exemplary, compensatory, punitive, special or

consequential damages, costs, expenses, legal fees, losses, lost income, lost profit, or opportunity costs.

Again, all information contained herein should be independently verified by your own research and your own independent

financial, investment, tax, and legal advisors prior to purchasing or selling any securities mentioned herein.

In addition to the specific disclosures mentioned herein, you are encouraged to read our general disclosure here:

EmergingGrowth.com/Disclosure.

Rating Definitions

Buy, 30% or greater price appreciation in the next 12 months.

Buy-Extended, near-term EPS and/or revenue horizon is challenging with strong long-term appreciation possibility.

Buy-Emerging, initial stages with low revenue and the potential for large returns with higher risk and volatility.

Hold, perform similar to market.

Sell, 30% or more decline in the next 12 months.

© Copyright 2026 Emerging Growth Research LLC

No part of this material may be copied, photocopied, or duplicated in any form by any means or redistributed without the

prior written consent of Emerging Growth Research LLC.