First Phosphate Corp. CSE: PHOS OTC: FRSPF

Building a Western phosphate platform for the LFP decade. Initiate with a Buy Rating. We initiate coverage on First Phosphate (FP) with a Buy rating and a 12- month target price of C$4.93. FP is building a Québec-based platform that upgrades rare igneous phosphate ore into 40%-41% P₂O₅ apatite concentrate and converts over 90% of this into battery-grade purified phosphoric acid (PPA) for LFP cathodes. We believe the market is underpricing the combination of ore quality, deep-water logistics at the Port of Saguenay, and a staged integration plan that generates cash from concentrate sales while the acid plant advances toward feasibility and FID. If management meets permitting, financing, and offtake milestones on the timetable discussed, we see scope for a re-rating toward a de-risked sum-of-the-parts outcome over the next 12 to 36 months.

Why now? LFP’s share of global batteries continues to rise while Western PPA remains scarce. FP stands out as one of the few projects with high-purity igneous feed, deep-water port access, and early proof-of-concept validation through fully North American LFP cells. The staged model (sell concentrate first, then internalize to PPA) provides transparent pricing anchors and lender-friendly offtake structures. We believe this situation is exactly the profile that capital is seeking for Western phosphate-to-LFP exposure.

What we model: We model first production in 2029 from the Bégin-Lamarche mine and concentrator, ramping to approximately 900ktpa of apatite concentrate at steady state. We allocate up to 400ktpa to a binding European offtake agreement and transfer the balance to the Port Saguenay acid complex, which we model at roughly 190ktpa on a P₂O₅ basis with a three-year ramp to 90- 95% utilization. Our model currently points to undiscounted free cash flow (FCF) of about C$3.5bn from the mine and about C$2.5bn from the PPA plant over a 23-year operating profile, before corporate items and funding effects.

Valuation: We use a sum-of-the-parts DCF that values the mine and PPA as separate legs with market-based transfer pricing on internal volumes and pre-FID risk adjustments. We apply discount rates of 12% for the mine and 14% for the PPA plant and arrive at a preliminary NAV of C$4.93 per share. At a current share price of around C$0.76, this valuation implies an upside of approximately 548%. We expect to revisit discount rates and risk premiums as feasibility, permits, offtakes and financing harden.

Investment Thesis

➢ FP’s demand growth meets PPA scarcity. Rising LFP penetration and scarce Western PPA supply creates a constructive backdrop. PHOS’s staged production model supports earlier

➢ Unit costs look competitive: Management has guided mine net cash cost to the mid-US$90 per tonne range after magnetite credits, consistent with the PEA life-of-mine opex framework. Port logistics shorten the mine-to-ship chain and should support a tighter workingcapital profile compared with inland peers.

➢ Two earnings legs at scale: At steady state, 400ktpa of external concentrate sales plus internal transfer of the remaining volumes to PPA creates two earnings legs. Management has indicated post-tax FCF from the mine alone averages about US$239mn per year, peaking near US$290mn, before layering in incremental PPA cash flows.

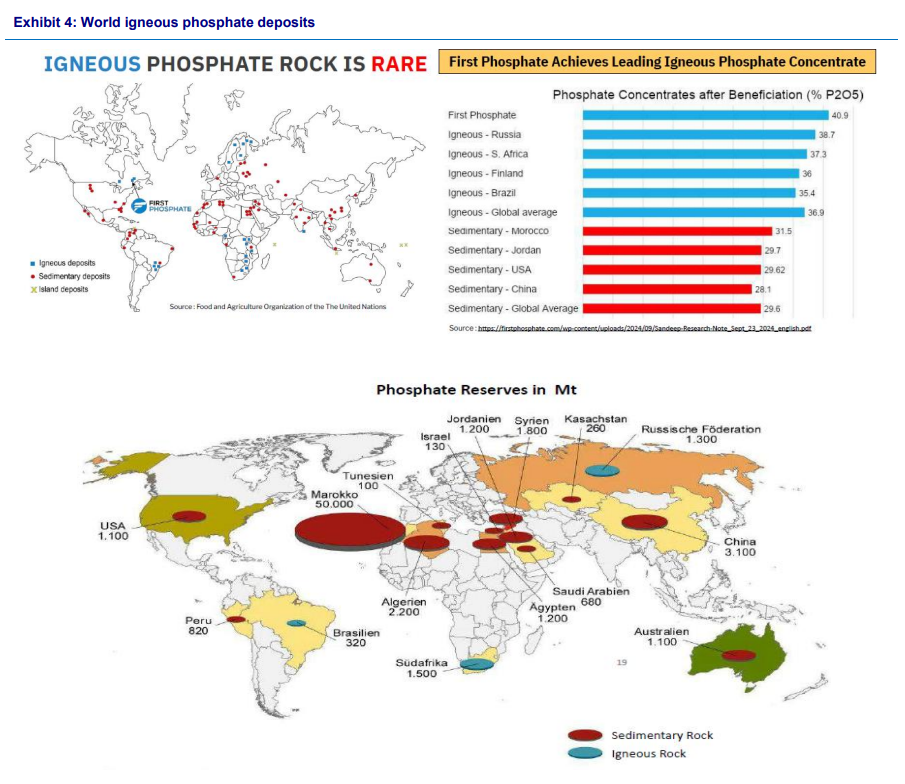

➢ Ore quality and rarity are real advantages: Only about 5% of global phosphate deposits are igneous, and PHOS’s ore upgrades to above 40% P₂O₅ concentrate with low impurities. Higher-purity feedstock should translate to better PPA yields and a more recyclable gypsum stream.

➢ De-risking milestones are visible: Feasibility work, permits, additional multi-year offtakes and/or volume expansions building on existing agreements, ECA and grant packages, and conversion of the Port Saguenay land option are all catalysts over the next 12 to 24 months.

➢ Early downstream proof points: PHOS has already helped produce LFP cells using fully North American critical minerals, with results presented. This outcome supports the fit of PHOS’s products for batterygrade applications and strengthens the narrative around a regionalized LFP supply chain.

➢ Valuation has room to keep re-rating: The Bégin-Lamarche PEA framed a pre-tax NPV of approximately C$2.1bn and an after-tax NPV around C$1.6bn, with a pre-tax IRR of about 37%. PHOS’s current equity value implies a steep discount to a de-risked mine-plus-PPA platform in Québec.

Industry insight – PPA as the bottleneck in the LFP build-out

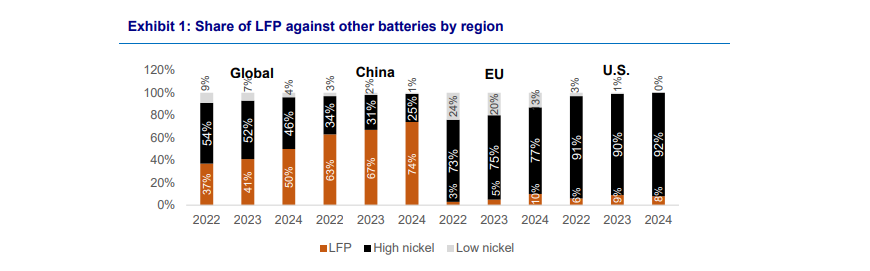

LFP becoming the workhorse for storage, data, and automation

LFP (Lithium Iron Phosphate) is now the leading chemistry for battery energy storage systems (BESS), data-centre backup,

and industrial automation, where safety, cycle life, and cost per kWh matter more than energy density. Grid-scale storage

is one of the fastest-growing battery markets globally, and most new BESS installations are shifting to LFP because it

handles frequent cycling and offers stable thermal performance. Data centres and AI infrastructure are also adopting

LFP for on-site peak-shaving and resilience as electricity demand is set to double by 2030. Warehouses, factories,

ports, and logistics hubs are accelerating the switch to LFP packs for robotics, AGVs, forklifts, and automation equipment.

LFP continues to grow in EVs, but we see the strongest incremental demand for Western PPA (Purified Phosphoric Acid)

coming from storage, data, and automation buyers seeking long-term, non-Chinese supply.

LFP’s addressable market is expected to grow at about 17% per year from US$19bn in 2024 to roughly US$90bn

by 2034, as automakers and grid-scale storage developers lean into LFP for cost, safety, and longevity. That growth collides

with a structural bottleneck in Western PPA and high-purity rock supply. Automotive accounted for about 5% of purified

PPA demand in 2023 and is expected to rise toward 24% by 2030. Without significant Western build-outs, the PPA

market could face a 1Mt/yr deficit by 2030. We therefore believe the investable takeaway is straightforward: purified

phosphates are tight, and new Western capacity should command healthy premiums to fertilizer-grade acid.

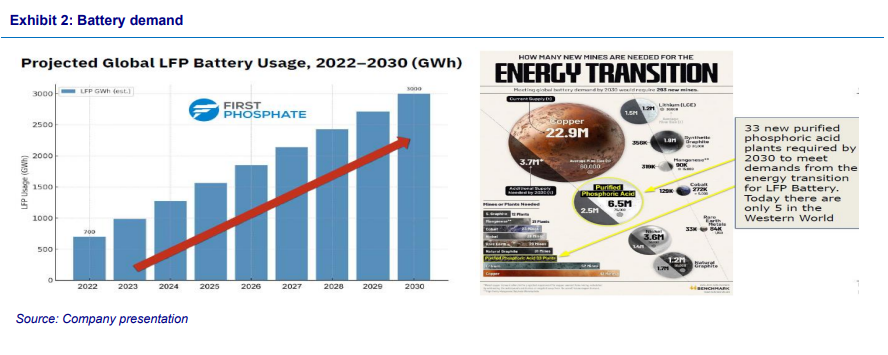

Scarcity of qualified PPA unlikely to fade quickly

The tightness in battery-grade PPA is not just an EV story. The same purified phosphates are needed for LFP cells that sit

inside grid-scale battery-energy-storage systems (BESS), data centre backup and peak-shaving units, and automation and

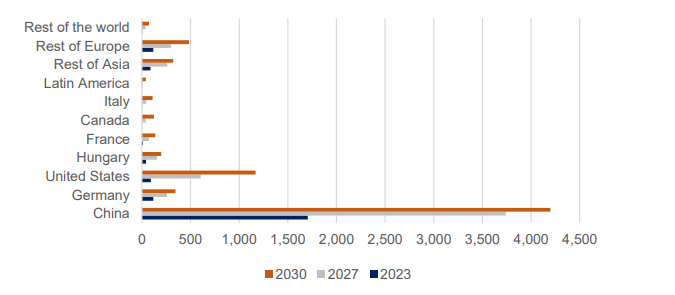

robotics platforms. Global cell manufacturing capacity is ramping sharply, led by China, which accounts for roughly two

thirds of installed capacity today and is still expected to hold more than 50% of projected 2030 capacity, with the United

States and Europe playing catch-up. As utilities add renewables and storage, and as hyperscale data centres, factories,

and logistics hubs electrify, demand for reliable, non-Chinese PPA rises alongside EV demand.

Western PPA capacity, however, remains thin and is mostly configured for fertilizer or captive industrial use. Converting

these plants to high-purity battery supply is non-trivial: operators must secure sulfuric-acid supply, meet tight impurity specs,

handle and monetise gypsum, and pass multi-year customer qualification. Greenfield battery-grade PPA projects face the

same hurdles plus permitting and capital constraints. The result is a limited pipeline of fully qualified, export-oriented

Western PPA projects. We see three implications for FP:

• Pricing power for qualified PPA: Benchmarks exist, but the pool of suppliers able to turn igneous feed into

consistent battery-grade PPA is small, which supports premiums over fertilizer-grade acid.

• Strategic relevance to storage and data-centric infrastructure: BESS and data-centre operators increasingly want

long-term, traceable, non-Chinese PPA supply from stable jurisdictions such as Québec.

• Favourable financing optics: Bankable offtakes indexed to transparent benchmarks, framed around energy security

and digital-infrastructure resilience, fit well with export-credit and government-support programmes.

Igneous rock – quality and scarcity as a strategic asset

Only about 5% of global phosphate deposits are igneous. The vast majority are sedimentary and tied to traditional fertilizer

chains. Igneous deposits, such as those of FP in Saguenay-Lac-Saint-Jean, typically upgrade cleanly to 39-41% P₂O₅

concentrate with lower deleterious elements. This geological advantage translates into:

• Higher acid yields and better PPA recovery

• Simpler purification and impurity control

• Cleaner, more recyclable gypsum by-product streams

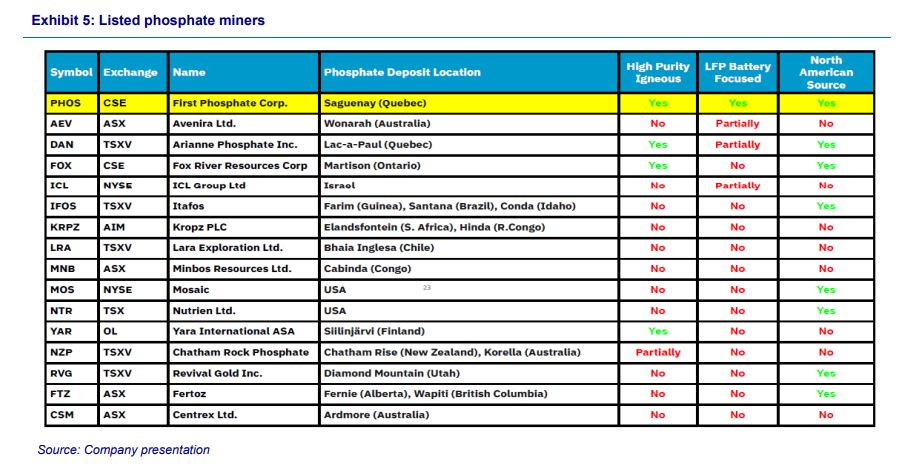

The scarcity of igneous rock in North America, coupled with declining sedimentary output and higher ESG scrutiny, supports

pricing power and lender confidence for projects like Bégin-Lamarche. Few listed names tick all three boxes of being North

American, igneous-based and explicitly LFP-oriented, which should widen the valuation range once financing milestones

become visible.

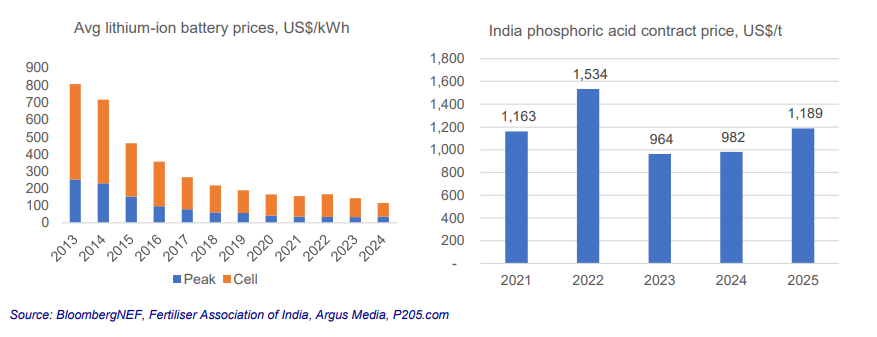

LFP’s growing share has helped stabilize battery prices in recent years even as ternary chemistries saw sharper declines.

We reflect this outcome in our base case by keeping LFP pack pricing broadly flat in 2025-2026 and easing thereafter as

scale and localization improve.