First Phosphate Corp. CSE: PHOS; OTC: FRSPF Flash Report

De-risking through successful fund raising and index inclusion. First Phosphate (PHOS) announced on December 22, 2025 it successfully closed the fourth and final tranche of its private placement financing having raised a total of C$9.6mn over the last couple of months with limited dilution. In these transactions PHOS issued a total 8.0m flow-through shares and 2.6mn ordinary shares at C$0.90 per share together with 2.6mn warrants with a strike price of C$1.25 which expire in April 29, 2026. Thus, over the last three years PHOS has raised C$49.7mn in ten private placement deals showing its top management’s remarkable ability to consistently raise capital while preserving equity dilution at limited levels. The proceeds raised will be used for activities related to final definition of its mineral resources at its Bégin-Lamarche phosphate flagship mining project and advancing it to feasibility study and for working capital financing.

Additionally, yesterday PHOS informed that it will receive an additional C$0.7mn as a lump-sum pre-payment coming from its existing, long-term phosphate concentrate offtake agreement with an existing partner to further finance final resource definition at its Bégin-Lamarche and to advance the project to a feasibility study and then start production. In relation to this agreement, PHOS is currently completing a 30,000-metre drill program in its Bégin-Lamarche project to finalize geological studies with the aim of converting indicated mineral resources into measured mineral resources. This drilling program should be completed by April 2026 when PHOS would decide to proceed with the feasibility study.

Lastly, another recent positive news was that on December 19, 2025, PHOS common shares have been added to the CSE25 Index as part of the Canadian Securities Exchange's quarterly index rebalancing. This action will increase PHOS’s visibility among investors and should help improve liquidity in the stock given additional demand coming from index-linked investment products.

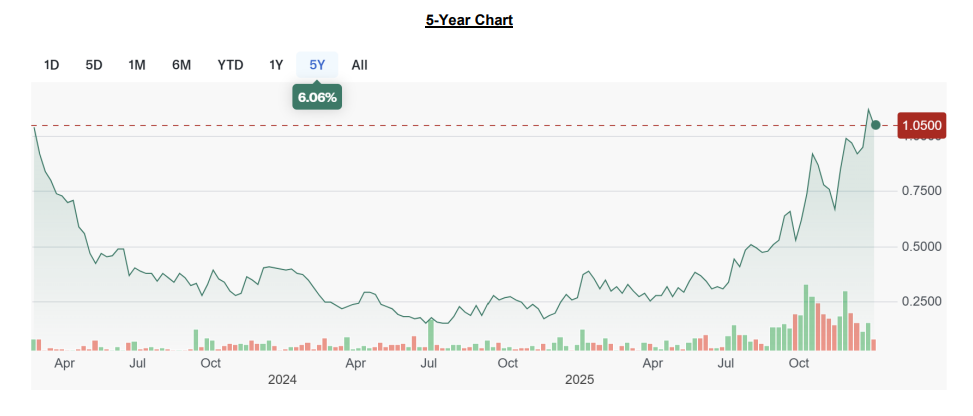

We view the above-mentioned positive news flow as contributing to de-risking PHOS’s investment case and reinforces our positive view on the stock, on which we see substantial upside potential. In our model we lowered our discount rate by 50 bps reflecting lower risk perception and improved visibility on potential positive catalysts for the stock ahead and, on the other hand, we increased the number of shares by 15%, reflecting the recent capital increase. All of this has a marginal impact on our PHOS target price which goes from C$4.93 to C$4.83.

Investment Thesis

➢ FP’s demand growth meets PPA scarcity. Rising LFP penetration and scarce Western PPA supply creates a constructive backdrop. PHOS’s staged production model supports earlier cash generation from concentrates while PPA qualifies and ramps.

➢ Transparent indexation reduces pricing risk: PHOS intends to index prices to well-known benchmarks. These anchors are familiar to lenders and support bankable offtakes and project finance.

➢ Unit costs look competitive: Management has guided mine net cash cost to the mid-US$90 per tonne range after magnetite credits, consistent with the PEA life-of-mine opex framework. Port logistics shorten the mine-to-ship chain and should support a tighter workingcapital profile compared with inland peers.

➢ Two earnings legs at scale: At steady state, 400ktpa of external concentrate sales plus internal transfer of the remaining volumes to PPA creates two earnings legs. Management has indicated post-tax FCF from the mine alone averages about US$239mn per year, peaking near US$290mn, before layering in incremental PPA cash flows.

➢ Ore quality and rarity are real advantages: Only about 5% of global phosphate deposits are igneous, and PHOS’s ore upgrades to above 40% P₂O₅ concentrate with low impurities. Higher-purity feedstock should translate to better PPA yields and a more recyclable gypsum stream.

➢ De-risking milestones are visible: Feasibility work, permits, additional multi-year offtakes and/or volume expansions building on existing agreements, ECA and grant packages, and conversion of the Port Saguenay land option are all catalysts over the next 12 to 24 months.

➢ Early downstream proof points: PHOS has already helped produce LFP cells using fully North American critical minerals, with results presented. This outcome supports the fit of PHOS’s products for batterygrade applications and strengthens the narrative around a regionalized LFP supply chain.

➢ Valuation has room to keep re-rating: The Bégin-Lamarche PEA framed a pre-tax NPV of approximately C$2.1bn and an after-tax NPV around C$1.6bn, with a pre-tax IRR of about 37%. PHOS’s current equity value implies a steep discount to a de-risked mine-plus-PPA platform in Québec.

Primary Risks

➢ Two-asset capex and funding mix, including potential dilution

➢ Construction and qualification risk for battery-grade PPA

➢ Volatility in benchmark pricing and input costs (India acid contract, phosphate rock, sulfur, power) ➢ Permitting timelines and environmental approvals

Valuation

➢ We value PHOS using a sum-of-the-parts approach. We discount the mine free cash flow at 11.5% and acid-plant free cash flow at 13.5% to reflect process and market risks prior to qualification, then apply project-stage risking prior to FID, and consolidate corporate items to equity value to arrive at a per-share target price of C$4.83. SOTP valuation Mine NAV, C$mn 460 PPA plant NAV, C$mn 351 Cash, C$mn 24 Total NAV 836 Shares outstanding, mn 173 NAV/share, C$ 4.83 Share price, C$ 1.05 Upside 360% Price/NAV 0.22x Key assumptions Discount rate – mine 11.5% Discount rate – plant 13.5% Mine cash opex/ton (adj for credits), US$ 95 PPA cash opex/ton, US$ 250 US$/CAD 1.38 P₂O₅ conversion factor 0.73 Battery grade purity premium, US$/tonne 45 Reserves Total mine resources, million tonnes (Mt) 150.55 Grade estimate 5.76% P₂O₅ Mine life ~24 years Strip ratio 1.5:1 (waste:ore) Implied mass yield to concentrate 13.7% (20.7 Mt conc./150.55 Mt feed) Implied P₂O₅ recovery: 90-95% (40% P₂O₅ concentrate)

Important Disclosures

Emerging Growth.com (“EG”) is a publisher and distributor of branded investment research reports provided by Emerging Growth

Research LLC (“EGR Report”) focused on both public and private companies. This report was prepared for institutional and

professional investors ONLY, and it is also known as Company Sponsored Research (“CSR”). Collectively, however (“EGR Report(s)”).

Be advised that this EGR Report is being provided by Emerging Growth Research LLC (EGR) solely for informational purposes, is not

the opinion of EG, should not be construed as an offer or solicitation to buy or sell securities, and should not be considered in any

decision to buy or sell any security mentioned within the EGR Reports. All information contained in the EGR Report as well as on the

EmergingGrowth.com website is obtained from sources believed to be reliable but not guaranteed to be accurate or all-inclusive, timely,

or correct. The information includes certain forward-looking statements, which may be affected by unforeseen circumstances and / or

certain risks. Because EGR is compensated as detailed herein and EG receives Licensing fees from EGR, as also detailed herein, EG

and EGR have a conflict of interest and strongly urge you to consult your own independent financial, investment, tax, and legal advisors

prior to purchasing or selling any securities mentioned herein.

The analyst that has prepared and is responsible for the content of this report has stated that neither he/she, nor any of his/her

associates both professional and personal, to the best of his/her knowledge have no personal or professional relationship with any of

the companies or principals of any companies mentioned within, other than providing services that EGR may offer.

EGR is being compensated by the subject Company of this report. EGR was paid two thousand four hundred USD for this report and

expects to receive an additional zero dollars over the following 12 months. EGR may have also received additional past compensation,

EGR may receive future compensation, and EG may receive compensation for additional services such as presenting on the Emerging

Growth Conference or investor or public relations services, details about which can be found in the full disclosure, here:

https://emerginggrowth.com/frspf-phos-egr-report-disclosure/.

It is the intent of EGR to provide continuing coverage on a quarterly basis, or otherwise for the subject Company of this report; however,

EGR and EG will not notify readers of this report if coverage by EGR, for any reason is terminated.

The reader or user of this content agrees that neither EGR and / or EG nor the analysts, directors, officers, employees, representatives,

independent contractors, agents or affiliates of EGR and EG shall be liable or held liable for any omissions, errors, or inaccuracies,

regardless of cause, foreseeability, or the lack of timeliness of this or any of our other reports to users. This lack of liability extends to

direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, losses,

lost income, lost profit, or opportunity costs.

Again, all information contained herein should be independently verified by your own research and your own independent financial,

investment, tax, and legal advisors prior to purchasing or selling any securities mentioned herein.

In addition to the specific disclosures mentioned herein, you are encouraged to read our general disclosure here:

EmergingGrowth.com/Disclosure.

Rating Definitions

Buy, 30% or greater price appreciation in the next 12 months.

Buy-Extended, near-term EPS and/or revenue horizon is challenging with strong long-term appreciation possibility.

Buy-Emerging, initial stages with low revenue and the potential for large returns with higher risk and volatility.

Hold, perform similar to market.

Sell, 30% or more decline in the next 12 months.

© Copyright 2026 Emerging Growth Research LLC

No part of this material may be copied, photocopied, or duplicated in any form by any means or redistributed without the prior written

consent of Emerging Growth Research LLC.