OSRH Holdings, Inc. NASDAQ: OSRH Flash Report

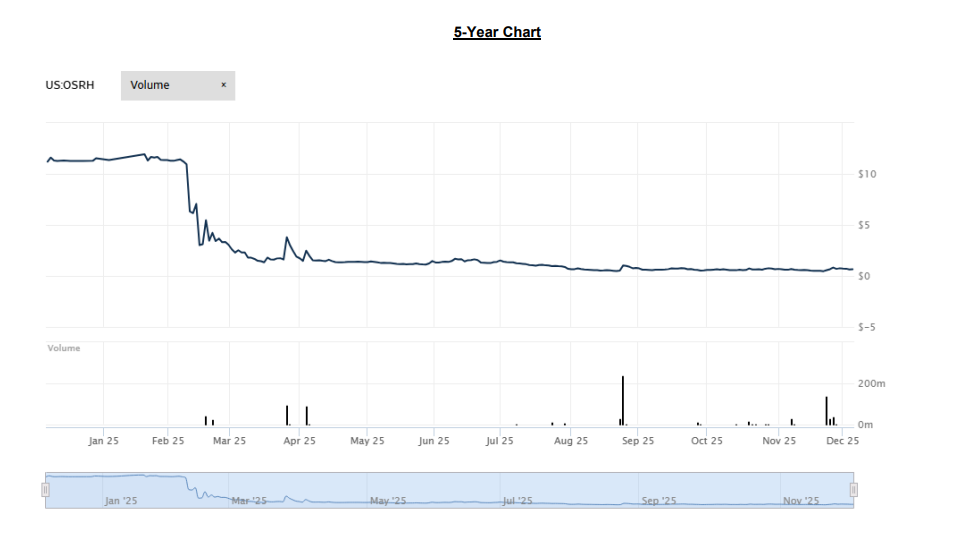

New Licensing Deal is a BIG Deal: OSRH announced a non-binding licensing term sheet with BCME (with new increasing probability of execution) for development of VXM01. The deal carries implications for strong 2026+ cashflow and longer-term prospects. The Company owns developmental platform technologies that address cancer immunotherapy and degenerative disease markets plus a largely de-risked, revenue-producing medical device distribution/4th party logistics (4PL) business and a diabetes medical device developer (currently in trials). Investors sold off OSRH shares in early 2025 on a market maker dispute, ELOC news, and potential naked short selling (unrelated to fundamentals). We focus on the future. If management grows 4PL, profitably integrates Woori IO, and successfully develops clinical and preclinical candidates (e.g., BCME licensing term sheet), price upside is substantial. OSRH management is now closer to proving it. We remain bullish with a BuyEmerging rating and a $10.00 price target (on watch for potential upgrade).

News

➢ OSRH recently announced an $815 million non-binding licensing term sheet regarding VXM01 (Phase 2b/3-ready oral T-cell immunotherapy drug program) with BCM Europe AG (BCME) regarding global development and commercialization rights to VXM01.

➢ Probability of successful execution of a definitive licensing agreement in coming months has now strengthened based on BCME’s formation of a fund structure anchored by a strategic pharmaceutical investor (currently confidential), accelerated exclusivity timelines from 6 to 3 months duration reflecting BCME’s heightened confidence, and potential expansion of the partnership scope to include additional oncology assets.

➢ With scope to expand down the road, the BCME non-binding term sheet includes milestone/other payments set to soon begin (e.g., $20 million upfront payment in 2026). This outcome is a material event in the Company’s history and underscores management’s credibility, domain expertise, due diligence validation, and downstream commercial optionality (i.e., multi-asset licensing structure that would potentially further increase valuation). Risks

➢ Limited operating history, early stage of its development programs, and risks inherent in drug development (e.g., non-binding licensing term sheet may not become reality).

➢ Significant shareholder dilution could still potentially occur over the coming year via an equity line of credit and shares-exchange acquisition.

➢ Additional naked short selling by market participants remains a possible headwind for shares to make upward gains, though multi-asset portfolio bodes well for news flow. Valuation

➢ OSRH shares have recovered off lows but remain beaten down reflecting prior concerns about cash burn and share dilution – both of which have now been mitigated.

➢ NOTE: Heavily-discounted valuation is dependent on projections provided by management and modeling assumptions. See October initiation report for more detail.

Important Disclosures

Emerging Growth.com (“EG”) is a publisher and distributor of branded investment research reports provided by Emerging

Growth Research LLC (“EGR Report”) focused on both public and private companies. This report was prepared for

institutional and professional investors ONLY and it is also known as Company Sponsored Research (“CSR”).

Collectively, however (“EGR Report(s)”).

Be advised that this EGR Report is being provided by Emerging Growth Research LLC (EGR) solely for informational

purposes, is not the opinion of EG, should not be construed as an offer or solicitation to buy or sell securities, and should

not be considered in any decision to buy or sell any security mentioned within the EGR Reports. All information contained

in the EGR Report as well as on the EmergingGrowth.com website is obtained from sources believed to be reliable but

not guaranteed to be accurate or all-inclusive, timely, or correct. The information includes certain forward-looking

statements, which may be affected by unforeseen circumstances and / or certain risks. Because EGR is compensated as

detailed herein and EG receives Licensing fees from EGR, as also detailed herein, EG and EGR have a conflict of interest

and strongly urge you to consult your own independent financial, investment, tax and legal advisors prior to purchasing or

selling any securities mentioned herein.

The analyst that has prepared and is responsible for the content of this report has stated that neither he/she, nor any of

his/her associates both professional and personal, to the best of his/her knowledge have no personal or professional

relationship with any of the companies or principals of any companies mentioned within, other than providing services that

EGR may offer.

EGR is being compensated by the subject Company of this report. EGR was paid one thousand and five hundred dollars

for this report and expects to receive an additional zero dollars over the following 12 months. EGR may have also

received additional past compensation, EGR may receive future compensation, and EG may receive compensation for

additional services such as presenting on the Emerging Growth Conference or investor or public relations services, details

about which can be found in the full disclosure, here: https://emerginggrowth.com/osrh-egr-report-disclosure/.

It is the intent of EGR to provide continuing coverage on a quarterly basis, or otherwise for the subject Company of this

report; however, EGR or EG will not notify readers of this report if coverage by EGR, for any reason, is terminated.

The reader or user of this content agrees that neither EGR and / or EG nor the analysts, directors, officers, employees,

representatives, independent contractors, agents, or affiliates of EGR and EG shall be liable or held liable for any

omissions, errors or inaccuracies, regardless of cause, foreseeability, or the lack of timeliness of this or any of our other

reports to users. This lack of liability extends to direct, indirect, incidental, exemplary, compensatory, punitive, special or

consequential damages, costs, expenses, legal fees, losses, lost income, lost profit, or opportunity costs.

Again, all information contained herein should be independently verified by your own research and your own independent

financial, investment, tax, and legal advisors prior to purchasing or selling any securities mentioned herein.

In addition to the specific disclosures mentioned herein, you are encouraged to read our general disclosure here:

EmergingGrowth.com/Disclosure.

Rating Definitions

Buy, 30% or greater price appreciation in the next 12 months.

Buy-Extended, near-term EPS and/or revenue horizon is challenging with strong long-term appreciation possibility.

Buy-Emerging, initial stages with low revenue and the potential for large returns with higher risk and volatility.

Hold, perform similar to market.

Sell, 30% or more decline in the next 12 months.

© Copyright 2025 Emerging Growth Research LLC

No part of this material may be copied, photocopied, or duplicated in any form by any means or redistributed without the

prior written consent of Emerging Growth Research LLC.